AGCO CORP /DE (AGCO)·Q4 2025 Earnings Summary

AGCO Beats on Revenue and EPS as Free Cash Flow Hits Record $740M

February 5, 2026 · by Fintool AI Agent

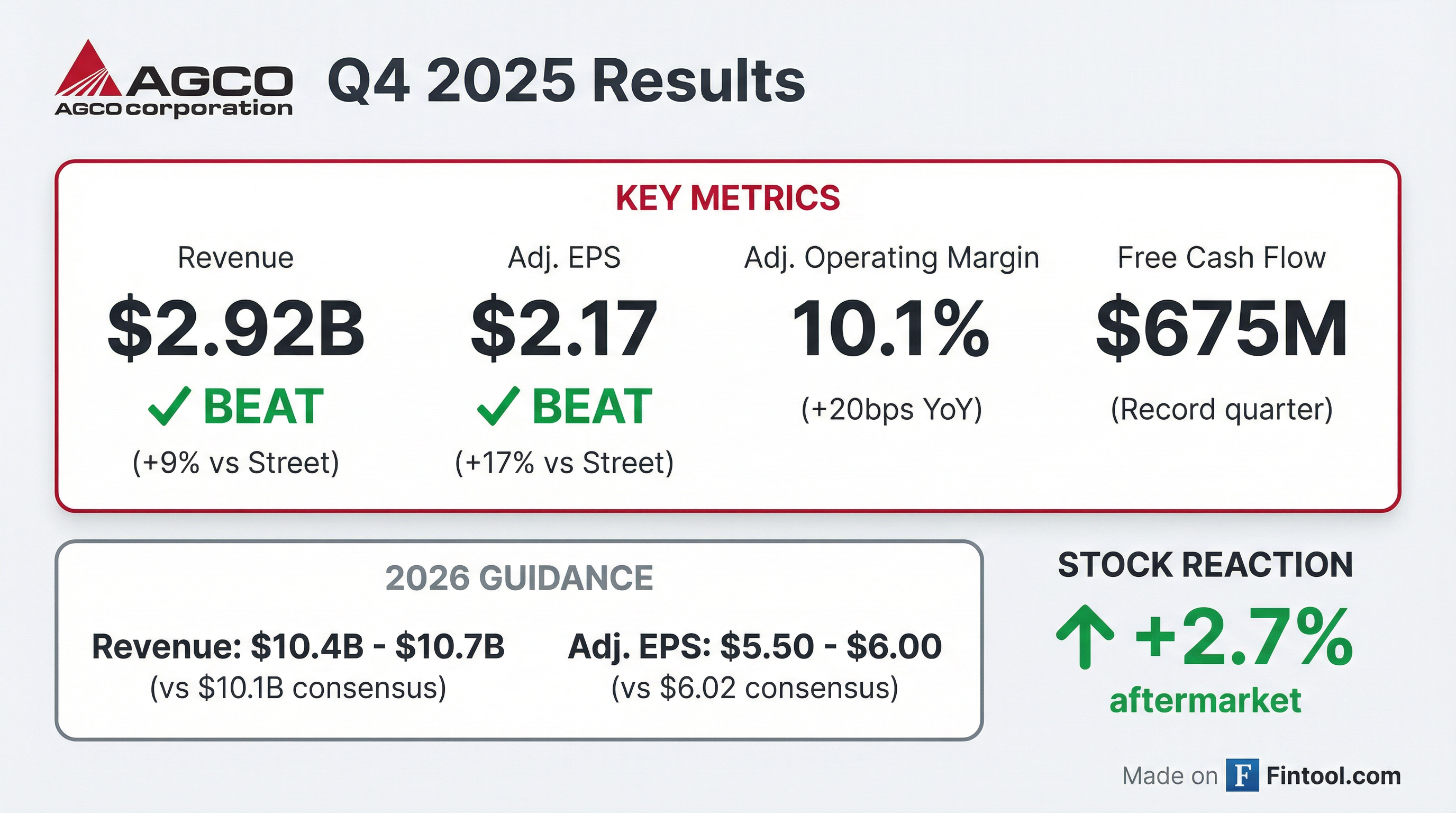

AGCO delivered a strong Q4 2025, beating analyst estimates on both revenue (+9.4%) and adjusted EPS (+16.9%) while generating record annual free cash flow of $740 million . The agricultural equipment maker closed out what CEO Eric Hansotia called "the best performance we've ever delivered at this point in the cycle," with adjusted operating margins nearly double prior troughs .

The company achieved its highest global market share in history during 2025, with North America posting the largest one-year gain in large ag market share . Customer satisfaction (Net Promoter Score) also hit an all-time high .

Shares rose 2.7% in after-hours trading to $125, bringing YTD gains to nearly 15%.

Did AGCO Beat Earnings?

AGCO delivered a double beat in Q4 2025, significantly outperforming Wall Street expectations:

*Consensus estimates from S&P Global.

The beat was driven by stronger-than-expected European performance and disciplined cost management. Adjusted operating income rose 3.4% year-over-year to $295.1 million despite production hours remaining flat vs. the prior year .

Full Year 2025 Results:

Revenue and EPS both exceeded consensus for the full year (revenue beat by 2.6%, EPS beat by 6.2%). The 7.7% adjusted operating margin during trough conditions represents approximately 300-350 basis points of improvement versus AGCO's performance at the 2016 trough.

What Did Management Guide for 2026?

AGCO provided 2026 guidance that came in above Street expectations on revenue but slightly below on EPS:

Key 2026 Assumptions :

- Relatively flat global demand (industry at ~87% of mid-cycle)

- Pricing up 2%-3%

- +2% favorable foreign currency impact

- Market share gains expected

- Further dealer inventory destocking

- Current tariff financial impact and mitigation actions reflected

The guidance assumes tariffs currently in place as of February 2026, with mitigation actions already embedded in the outlook.

What Changed From Last Quarter?

Several notable shifts from Q3 2025:

-

Free Cash Flow Accelerated: Q4 FCF of $675 million was exceptional, driving full-year FCF conversion to 188% of adjusted net income—well above the 75%-100% target

-

Europe Momentum Strengthened: Europe/Middle East delivered 7.9% sales growth in Q4 (excluding currency), representing 67% of full-year sales

-

Production Stabilizing: After cutting production hours 12% in 2025, AGCO expects flat production in 2026

-

Share Repurchases Ramped: Repurchased $250M in Q4 as part of the $1B authorization

-

TAFE Divestiture Complete: Gain on sale of investment in affiliate (TAFE) contributed to reported results

How Did the Stock React?

AGCO shares jumped 2.7% in after-hours trading following the earnings release, reaching $125. The stock has been on a strong run heading into earnings:

Recent Performance:

- After-hours: +2.7% to $125

- Day of earnings: +2.9% to $121.68

- YTD 2026: +15%

- 52-week range: $73.79 - $122.00

The market appears to be rewarding the revenue and EPS beats, as well as the strong free cash flow generation and above-consensus revenue guidance for 2026.

What Did Management Say?

CEO Eric Hansotia on Cycle Positioning :

"Our adjusted operating margins are among the best in AGCO's history and the strongest we've ever delivered at this point in the cycle. We have nearly doubled our adjusted operating margins from prior troughs and are close to prior industry peaks."

On Record Market Share :

"Overall, AGCO turned in the highest market share in our history in 2025, and that's global. Net Promoter Score, which is our customer feedback to AGCO, hit its all-time high in 2025."

On 2025 as the Trough :

"2025 was the bottom of the trough, and the fleets in our major markets are at the peak of their age, so we expect that the future looks brighter."

Regional Performance: Europe Leads, North America Lags

AGCO's regional mix continues to shift toward Europe, which now represents 67% of sales:

2026 Regional Market Outlook :

- North America: Large Ag down ~15%, Small Ag up modestly

- Western Europe: Up modestly, supported by aging fleet and stable farm economics

- Brazil: Approximately flat, with pressure early and stronger second half

Regional Margin Outlook for 2026 :

- Europe: Expected to remain at ~15% operating margin

- North America: Negative margins for first 2-3 quarters; 10% underproduction in H1

- South America: Modestly better than 2025 full year, but worse in H1

The company continues to benefit from geographic diversification, with Europe providing stability (dealer inventory at 4-month target) while North American large ag markets remain challenged (7 months vs. 6-month target) .

PTx Precision Agriculture: The Long-Term Growth Driver

AGCO highlighted continued progress with PTx (the Trimble joint venture), which is central to its long-term margin expansion thesis :

2025 PTx Results:

- Revenue: ~$860 million, on or above plan every quarter

- Elite Dealers: Grew from ~40 to 70+ globally (dealers carrying full PTx product line)

- 2026 Outlook: Flat to modestly up revenue expected

Key Product Launches from Winter Conference (4,000+ farmers attended) :

- SymphonyVision Duo: Dual-nozzle spot-spray system delivering 60% chemical cost savings. Unique injection system mixes solutions for higher uptime than competitors

- ArrowTube: Breakthrough seed delivery placing seeds tip-down for optimal emergence and sunlight capture. "Nothing else like it in the world" - CEO

- FarmENGAGE: Farmer-facing digital platform integrated into all MY2026 Fendt and Massey Ferguson machines in North America

Retrofit Advantage: The retrofit market is outperforming equipment—down only ~33% vs. the broader market decline . Farmers prioritizing productivity improvements on existing fleets creates a counter-cyclical revenue stream.

Management's long-term targets :

- 14%-15% adjusted operating margin at mid-cycle by 2029

- 4%-5% above-industry volume growth

- 75%-100% annual free cash flow conversion

Capital Allocation: Record Cash Returns

AGCO generated record free cash flow in 2025 and is returning significant capital to shareholders:

The strong FCF was driven by better working capital performance (larger benefit than expected) and lower capital expenditure vs. 2024 .

Q&A Highlights

On US Inventory Destocking Timeline (Stephen Volkmann, Jefferies):

"We did finish the year a little bit above our six-month target, so we will have some underproduction here, likely in the first half of the year in North America... around 10% underproduction, give or take."

On Market Share Gains (Mig Dobre, Baird):

"AGCO turned in the highest market share in our history in 2025, and that's global... North America was the largest one-year gain in market share for large ag in North America."

On North America Margins (Jamie Cook, Truist):

"North America margins are going to be negative, likely for the first two to three quarters... Q1 and Q2 will likely be worse year-over-year given the underproduction and the decline in the large ag market."

On Tariff Impact (Tami Zakaria, J.P. Morgan):

"The incremental tariff costs in our P&L in 2026 versus 2025... about a $65 million headwind year over year... absolute total tariff cost in 2026 will be just around $105-$110 million."

On Europe Outlook (Kristen Owen, Oppenheimer):

"The fleet age is almost back to its record peak... that's creating a lot of pent-up demand... we're bullish that we think the market's gonna be up in EME this year."

Key Risks and Concerns

-

Tariff Headwind Quantified: $65 million incremental tariff cost in 2026 vs. 2025, with total tariff impact of $105-110 million (~1% of sales). At the midpoint of pricing guidance (2.5%), the price/cost equation is margin dilutive

-

North American Weakness: Large ag demand expected to decline another 15% in 2026. North American margins expected to be negative for first 2-3 quarters

-

EPS Guidance Below Consensus: While revenue guidance beat, the $5.50-$6.00 EPS range came in slightly below the $6.02 Street estimate

-

Dealer Inventory Still Elevated: North America at 7 months vs. 6-month target; South America at 5 months vs. 3-month target

Cost Transformation Progress

AGCO highlighted significant progress on its "Project Reimagine" cost reduction initiative :

Key Initiatives:

- AI Deployment: 160 agentic AI projects in flight, 50 completed—automating processes and streamlining dealer/customer interactions

- Low-Cost Country Sourcing: Aggressive shift of supply base from high-cost to low-cost countries in 2026-2027

- Process Standardization: Simplified processes being offshored to lower-cost AGCO locations or outsourced to third-party providers

Forward Catalysts

- Industry Recovery: Management views 2025 as the trough with modestly higher demand expected in 2026. "2025 was the bottom of the trough, and the fleets in our major markets are at the peak of their age"

- PTx Synergies: Continued rollout of precision agriculture solutions driving premium pricing and share gains. ArrowTube and SymphonyVision Duo expected to generate strong demand in 2026

- Margin Expansion: Targeting 14%-15% adjusted operating margin at mid-cycle by 2029

- Share Repurchases: $750M remaining on $1B authorization

- Record Customer Satisfaction: Net Promoter Score hit all-time high in 2025, along with record patent filings

Data sources: AGCO Q4 2025 Earnings Presentation, S&P Global estimates. Stock prices as of February 5, 2026.